Page History: Service Charges Help Documentation

Compare Page Revisions

Page Revision: 01/10/2018 03:23 PM

Service Charges

Service Charges are fees added to a customer account for carrying an outstanding balance.

The first step in using

Service Charges is to setup the service charge fields in the customer record.

You will always have the option to review and choose whether or not to post

Service Charges to a customer’s account during the processing.

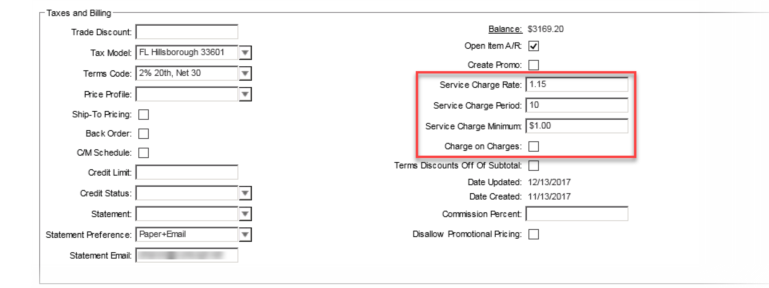

Setting up a Customer for Service Charges

From the

Edit Customer screen, under

Taxes and Billing:

| 1. | Enter the Service Charge Rate. This is the percentage rate that will be calculated against the outstanding balance(s). |

| |

| |

| Example: An outstanding invoice for $597.25 at a Service Charge Rate of 1.15% would receive a service charge of $6.87. ($597.25 x 1.15% = $6.87) |

| |

| |

| 2. | Enter the Service Charge Period. This is the grace period allowed before a service charge will be posted to the account for outstanding balance(s). |

| |

| |

| Example: The invoice is due on 12/7. The Service Charge Period is set to 10. On 12/17, the invoice will be past the grace period of nine days and a service charge will be posted to the account. (12/7 + 10 days = 12/17) |

| |

| |

| 3. | Enter the Service Charge Minimum. If a calculated service charge is less than the Service Charge Minimum, this minimum amount is what will be posted against the account. |

| |

| |

| Example: If the calculated service charge only comes to $ 0.63, then $1.00 would be posted to the account instead. |

| |

| |

| 4. | When the Charge on Charges is checked, service charges will be calculated against prior unpaid service charges also. |

| |

| |

| Example: The past due invoice for $597.25 has had a service charge of $6.87 already posted to the account. The outstanding account balance is now $604.12. ($597.25 + 6.87 = $604.12) |

| |

| |

| If the Charge on Charges is checked, in the next cycle the service charge would be calculated against the entire outstanding account balance and would be $6.95. ($604.12 x 1.15% = $6.95) |

| |

| |

| If the Charge on Charges is not checked, in the next cycle the service charge would be calculated against only the outstanding invoice again and would be $6.87. ($597.25 x 1.15% = $6.87) |

| |

| |

Changing the Service Charge Rate or Period

When and invoice is created, the current Service Charged Rate or Period is applied to that invoice. If you change the Service Charge Rate or Period, the new rate or period will only apply to invoices created after the change is made.

| | Example: This customer’s Service Charge Rate was 1.25%. On 6/1/2017, the Service Charge Rate was increased to 1.50%. Invoices before the change still carry a Service Charge Rate of 1.25%. |

| | Invoice Date | | Invoice Amount | | Service Charge Rate | | Service Charge Applied |

| | 5/1/2017 | | $193.18 | | 1.25% | | $2.41 |

| | 5/23/2017 | | $147.60 | | 1.25% | | $1.85 |

| | 6/3/2017 | | $126.75 | | 1.50% | | $1.90 |

| | 6/19/2017 | | $240.37 | | 1.50% | | $3.61 |

To apply a new

Service Charge Rate to past invoices, use the

Apply Service Charge Percentage action link on the

Edit Customer screen.

The confirmation window will open. Select

Yes to confirm, or select

No to cancel.

Changing the

Service Charge Period works in the same way. You can change both the rate and period at the same time.