Page History: A/R credit holds

Compare Page Revisions

Page Revision: 04/30/2015 03:44 PM

A/R Credit Holds

A/R Credit Holds is a new feature that allows Jobbers to strictly enforce credit limits for their customers. It works by calculating a customer’s balance granularly, taking into account shipped orders and un-posted invoices. This feature also allows a high-level employee to temporarily raise the credit limit of a customer for a specific document and a specific amount. Credit Holds only apply to customers with a credit limit, and whose credit status is listed as “Good”.

Please note that this feature trumps the existing credit override permissions.

Setup

Customer Maintenance¶

Verify that the customer’s Credit Limit is specified. The Credit Limit is used to determine the maximum amount of credit you are willing to extend the customer before transactions are blocked.

=

=Security===

=

The Accounts Receivable manager must be assigned a new permission, AR_CreditHoldOverride_Authorize. This permission allows the manager to access the Customer Credit Override screen, where the manager can temporarily grant access to additional credit when necessary.

===Settings

===

There are two new settings in the Preferences section of ComCept.Net Thin Client. These can be found in the Documents section.

The Show customer Credit Status on Point-of-Sale documents settings simply displays a customer’s Credit Status on the Work Order, Shipment, Invoice and Quote screens. Whenever you select a customer on one of these pages, the Credit Status for the customer will appear, presenting valuable decision-making information. This setting doesn’t stop the document from being saved, it only displays the up-to-date credit information of the selected customer. If you are using the “Find Open Orders” feature, this feature will combine into the same popup message.

The Stop transactions when customer potentially exceeds credit limit setting is the enforcer of the credit limit. When this setting is activated, any shipment or invoice that will potentially go over the customer’s credit limit will not be allowed to save.

These settings are location-specific, so you can use the feature at some or all locations as needed. You can use each of the options independently, though we recommend that they be used together.

How AR Credit Holds works

Credit Status

The Credit Status pop-up is a small message that appears on the bottom of the Work Order, Shipment, Invoice and Quote screens. It provides real-time credit information for the selected customer, including all posted and un-posted documents.

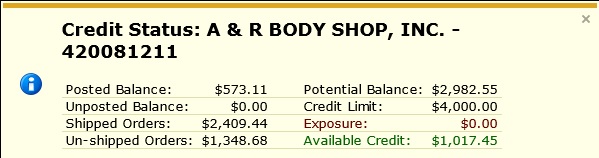

Below are two examples of the Credit Status pop-up. The following example is for a customer with an established line of credit:

This example is for a customer without a credit limit:

Credit Status Details

Posted Balance – The sum of all posted invoices and credits, as well as unapplied payments. Before A/R Credit Holds, this was the value referred to as “Customer Balance”.

Un-posted Balance – The sum of all open invoices and credits. These documents are not yet part of the Posted Balance until a Transaction Journal is run, but they still apply to the customer’s “Potential Balance”.

Shipped Orders – The sum of all shipped goods from Work Orders that have not been invoiced. This may include line items on orders that have unshipped lines, but it refers only to the shipped portions of those orders. Once the shipments have been invoiced, the totals will move to the Un-posted Balance.

Un-shipped Orders – The sum of all un-shipped goods from Work Orders. This may include line items on orders that are partially shipped, but it refers only to the un-shipped portion of those orders.

Potential Balance – The customer’s balance once all shipments have been invoiced and invoices have been posted. This is the sum of this customer’s Posted and Un-posted balance, plus the value of all shipped orders. Un-shipped orders do not factor in this total, since the goods have not left the distributor’s possession.

Credit Limit – The Credit Limit value from Customer Maintenance.

Exposure – The amount this customer’s potential balance is already past their credit limit.

Available Credit – The amount of credit still open for the customer to use before exceeding their limit.

Credit Holds

A Credit Hold is when ComCept prevents users from saving a shipment or invoice that will push the customer over their credit limit. It will also prevent a CollisionLinx order from being converted directly into an invoice and WO processing from shipping or invoicing a work order.

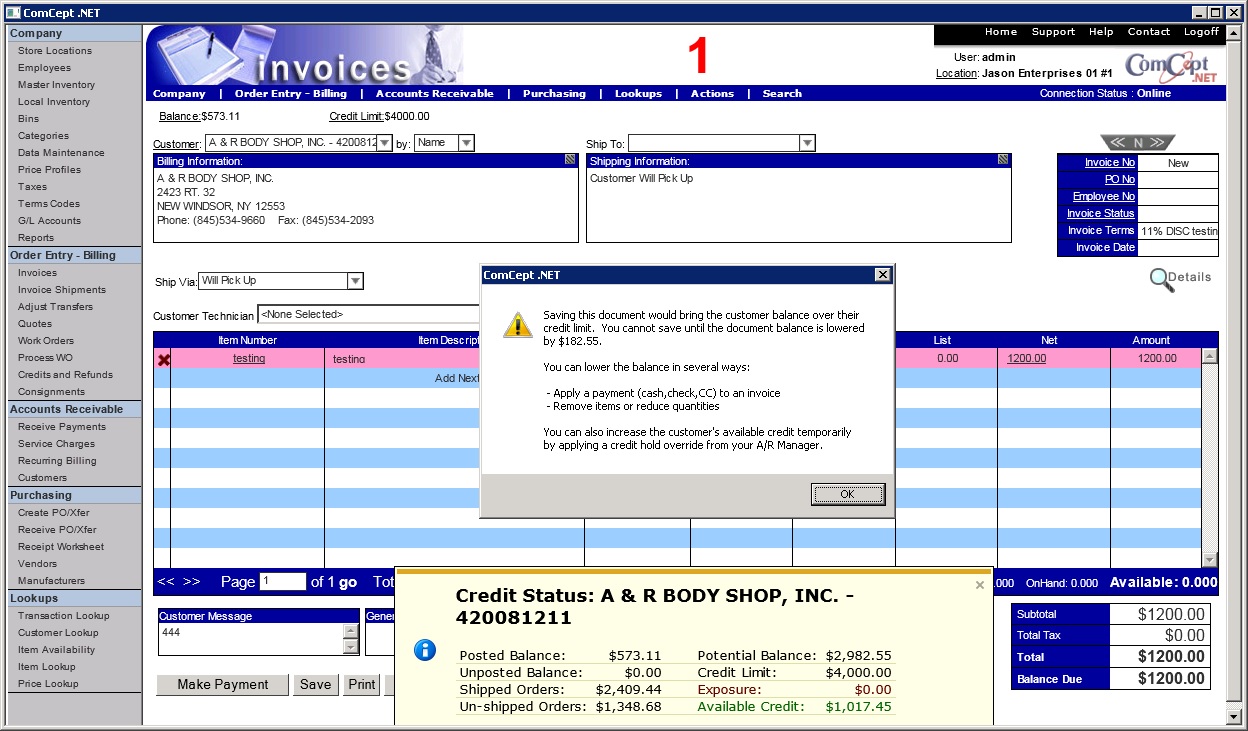

Here is an example of an invoice being blocked. Notice the customer has a remaining credit limit of $1,017.45 and the order is for $1,200.

The salesman has three options:

- Reduce the document amount to get the customer under their credit limit

- Collect some form of payment from the customer to lower the balance

- Obtain a Credit Hold Override code from the A/R Manager

Credit Hold Overrides

Sometimes it is necessary to allow a salesman to save a document that will take the customer over his limit. The A/R Manager has authority to grant a temporary increase in the customer’s credit limit if needed, so the salesman can save a document that would otherwise be blocked. This is done by supplying the salesman with a Credit Hold Override code.

The override actually raises the “Available Credit” by a specific amount until the document is saved, giving the salesman a short opportunity to increase the document amount for a special circumstance. Credit Hold Overrides do not permanently affect the customer’s Credit Limit in Customer Maintenance, they merely allow a one-time special case to be handled gracefully at point-of-sale.

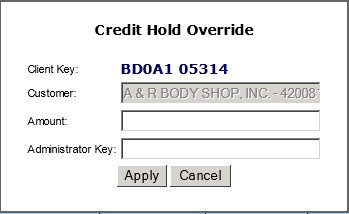

Using the example above the customer needs to increase their Available Credit by $182.55 in order to save the document. The Salesman would open the Actions menu from the invoice or shipment screen and select Override Credit Hold. The Credit Hold Override screen will appear.

The salesman will then have to contact the A/R Manager and explain the situation to them. If the A/R Manager agrees to increase in Available Credit the salesman will provide the Client Key, customer name and amount of increase needed.

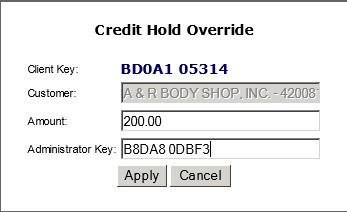

The A/R Manager will enter all of this information into the Customer Credit Override screen. Then select the Generate Key button.

The A/R Manager will tell the salesman the generated key and how much additional credit they approved. The salesman will enter the key into the Administrator Key field and the amount into the Amount field.

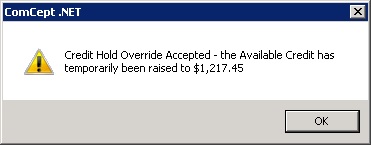

Next the salesman will select the Apply button. If all of the information matches what the A/R Manager entered, the salesman will receive the message below:

A rejection message will appear if the salesman didn’t enter the correct code or the correct amount.

NOTE: in cases where the A/R Manager made a mistake while entering the data, the salesman must close the Credit Hold Override and re-open it to provide a new Client Key to the A/R Manager.

WO Processing

AR Credit will prevent any work order from potentially going over that customer’s credit limit when the Ship or Ship/Invoice option is selected. It will auto-deselect the documents that were blocked to allow the salesman to process the rest of the documents smoothly. The only way to process blocked work orders is to go to the ComCept.Net Work Order Screen.

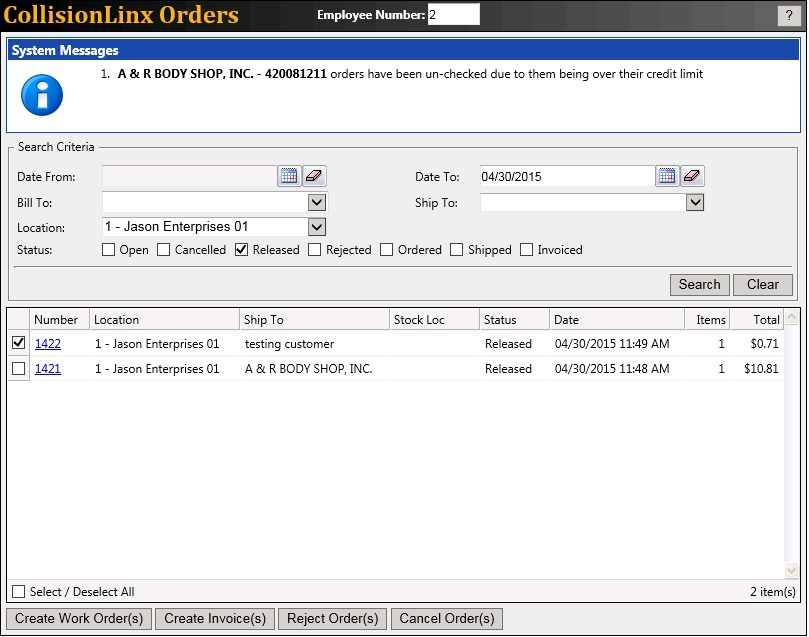

CollisionLinx Orders

CollisionLinx orders can be blocked when the salesman selects the Create Invoice(s) button. If a document is blocked, the salesman can process them as a Work Order. This screen also auto-deselects blocked orders to allow the salesman to easily process the other documents.

Please note that on both the CollisionLinx Orders and the WO processing screens, if the salesman is accepting multiple orders for the same customer and the combined total will push the customer over their credit limit, all orders for the offending customer will be unchecked. The salesman will have to process the orders manually by selecting fewer documents.

Reporting

Every time a Credit Hold Override is granted, ComCept logs the following details:

- Salesman requesting the override

- Administrator granting the override

- Customer receiving the override

- The Client Key supplied by the salesman

Owners and A/R Managers can run the Credit Override Audit report from the Admin category to see a historical list of Credit Hold Overrides, and can filter by customer, salesman or administrator. This can help identify abuse of the Override feature.