Page History: Credits and Refunds

Compare Page Revisions

Page Revision: 11/17/2011 03:18 PM

Credits and Refunds¶

This task is used to credit (credit to account) or refund (cash, check, or charge card credit issued) a customer for product returned or services not used.

Select

Credits and Refunds from the

Navigation Bar or from the Drop Down Menu

Order Entry – Billing.

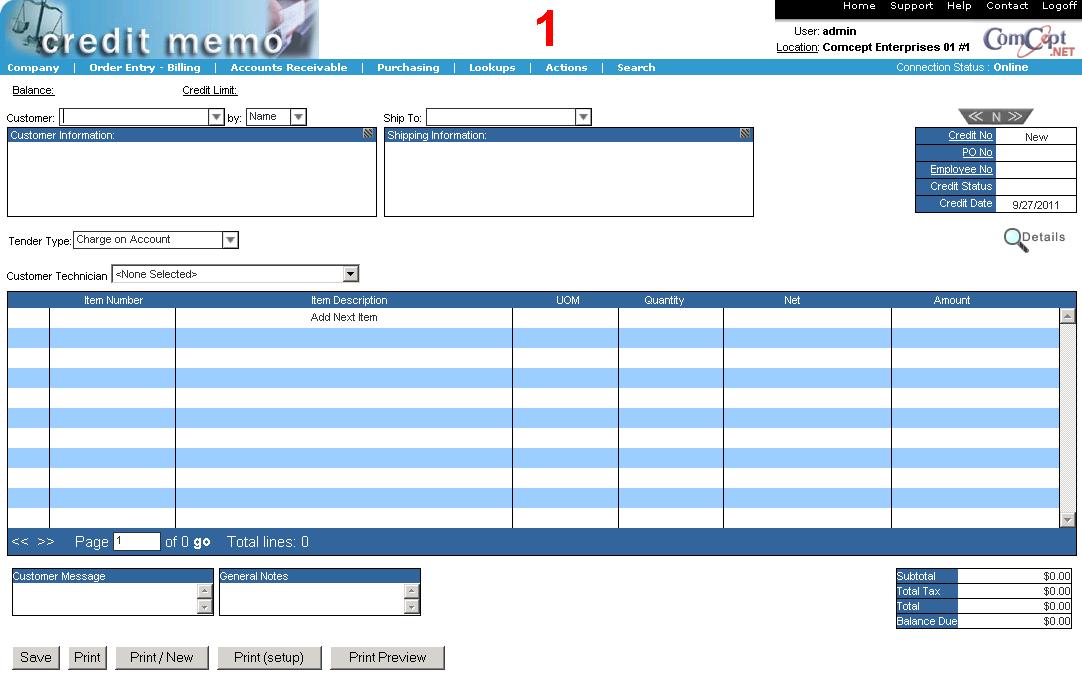

Credit Memo Screen

This is the

Credit Memo screen.

It is important the

User and the

Location are correct because multiple users and locations can be accessed from the same computer. These are located in the top right area of the screen.

The

Credit Memo screen is similar to the

Invoices screen except for:

- There is no Ship To customer drop down box.

- The Tender Type must be selected.

- The Credit Memo Action Icons are Save and Print.

- The Actions drop down menu contains:

Tender Type:

Tender Type: Select the desired tender type for the credit memo from the drop down box:

The

Customer Message box can be used to document the reason for the refund and to record the invoice number and date of the original sale.

The

Save button saves the Credit Memo. This action updates the on hand quantity.

The

print button prints and saves the Credit Memo. This action updates the on hand quantity.

Credit Memo Actions Menu

The following actions are available from the

Actions drop down menu while in the

Credits and Refunds task.

Credit Sales Tax:

Credit Sales Tax: Use this action to create a Credit Memo for sales tax only.

Save: Saves the Credit Memo as described above.

Print: Prints and saves the Credit Memo as described above.

Print / New: Prints and saves the Credit Memo. Once the printing is completed, a new Credit Memo is opened.

Print (setup): The print dialog window appears. You can change where the Credit Memo will print to and edit some of the paramters.

Print Preview: A Print preview of the Credit Memo will be displayed. You can print the Credit Memo from the print preview screen or close it.

Recurring Billing: The Recurring Billing dialog window will appear. once the window is filled out the Credit memo will become part of the Recurring Billing cycle.

Void

Void: Voids the credit memo that is currently displayed.

Price Lookup: The Price lookup screen will be displayed. The customer and location will automatically be populated if the customer is already selected. A second Price Lookup link is in the Line items detail dislog. This link will populate all of the fields on the Price Lookup screen.

Add Customer: This action builds a new customer.

Scan Barcodes: The barcode window will be displayed. Any valid UPCs can be scanned and automatically added to the Credit Memo.

Credit Sales Tax

This action creates a Credit Memo for sales tax only.

Credit Sales Tax

Credit Amount:

Credit Sales Tax

Credit Amount: Enter the amount of the credit. You must credit each taxing authority separately but they can be combined on one invoice.

Tax Item: Select the appropriate tax item name for the taxing authority that this credit amount is to be applied against.

Notes: Enter the reason for the credit. Be very specific so as to reduce the chance for rejection by the taxing authority if your records are reviewed.

Select the

Ok button to add this sales tax credit to the current invoice or the

Cancel button to discard the credit.

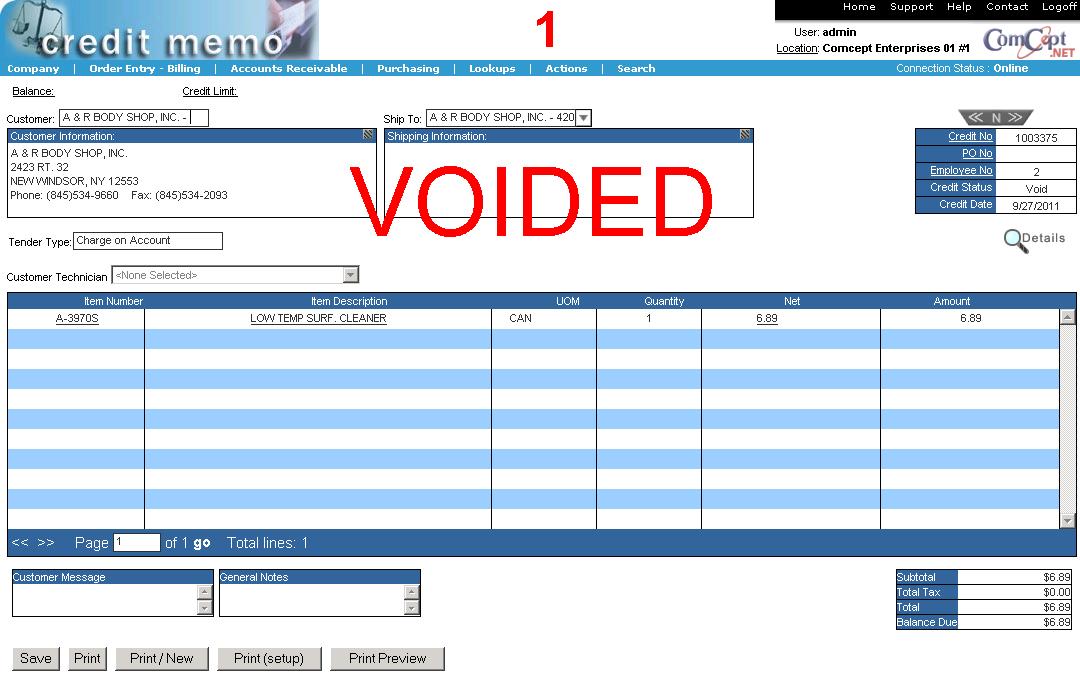

Void Credit Memo

This action voids an open credit memo (either printed or only saved). The following adjustments are made:

- The credit memo will not be added to the customer’s accounts receivable.

- The quantities returned are removed from the on hand inventory for the items on the credit memo.

- The transaction will not be recorded in historical sales (used for reports and purchasing).

The credit memo to be voided must be displayed on the screen. You cannot void a released (posted) credit memo.

Select

Actions then select

Void Credit Memo.

The void credit memo confirmation window is then displayed:

Select

Yes to void the credit memo or

No to return to cancel the void credit memo process.

The voided credit memo is then redisplayed with the phase

VOIDED displayed in red across the face of the credit memo.

When a voided credit memo is reprinted, the phase

VOIDED CREDIT MEMO prints in the upper right corner.

Credit Memo Due Date

Credits and Refunds use the Credit Memo Date as the Due Date for calculating aging and on reports. On the customer statement the Due Date is left blank.